Margin call options

A Call option is your right to buy a security at a specified price by a defined date. The CFD providers may call upon the party to deposit additional sums to cover this in what is known as a margin call.

What Is A Margin Call Margin Call Formula Example

Under most margin agreements even if your firm offers to give you time to increase the equity in your account it can sell your securities without waiting for you to meet the margin call.

. Overnight Margins 330pm CT 700am CT The customer must have 150 of the Exchange Initial Margin to carry the position overnight. Using margin to trading options may expose you to significant investment risks. The concept of margin is one of the most fundamental concepts to grasp while trading futures and options.

What is a Margin Call. Among the options available to them they have the right to increase their margin requirements or choose not to open margin accounts. In fact using this type of loan rather than selling existing securities or using cash on hand can help to avoid disruption to your long-term investing goals and could help you avoid potential tax consequences of selling securities.

The option position stands at 582000 600 x 970. Please call our Trade Desk who will request authorization from StoneX Financial Inc. Under these authorisations Options Trading IQ is authorised to provide general financial product advice in respect of certain classes of financial products which include securities.

The Ulta Beauty team delivered outstanding performance again this quarter. Buying on margin refers to the initial or down payment made to the broker for the. We appreciate your continued interest in Ulta Beauty.

If you decide to use margin here are some additional ideas to help you manage your account. Likewise the space shuttle had recently wrecked and her the movie shows us Peter Sullivan in finance instead of rocketry. A well-diversified portfolio may also help make margin calls less likely as you would avoid the risk of having a single position drag down your portfolio.

Options Trading Using Margin. Options Trading IQ Pty Ltd ACN 658941612 is a Corporate Authorised Representative 001296496 of Network Influencer Pty Ltd AFSL 282288 trading as FZeroZero. Thank you Kiley and good afternoon.

Pay 20 upfront margin of the transaction value to trade in cash market segment. InitialRegT End of Day Margin. A margin loan may be an alternative approach to help meet short-term financial needs that are not related to trading.

Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. In fast moving markets margin calls may be at short notice. Dave Kimbell-- President.

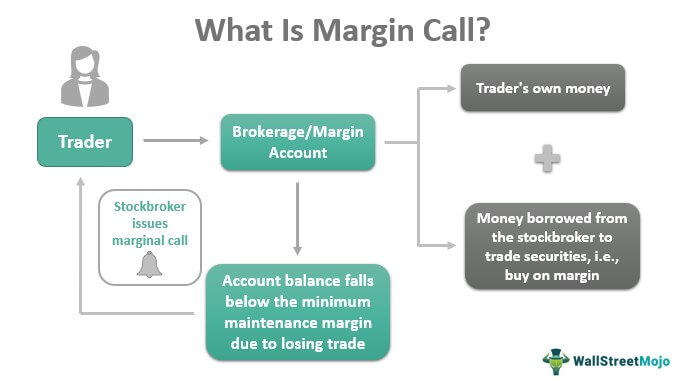

Day Trade Margins 700am CT 400pm CT 100 of Exchange Initial Margin. A Margin Call occurs when the value of the investors margin account drops and fails to meet the accounts maintenance margin requirement. In the context of the NYSE and FINRA after an investor has bought securities.

The FCA imposed further restrictions on 1 August 2019 for CFDs and 1 September 2019 for CFD-like options with the maximum leverage being 301. The variation margin payment is deemed necessary once the funds in a trading account drop lower than the maintenance margin. Profit value at expiry - option cost number of contracts 100 _____ stock price - strike - option cost _____ number of contracts 100.

Some of the more commonly day-traded financial instruments are stocks options currency including cryptocurrency contracts for difference and futures contracts such as stock market index futures interest rate futures currency futures and commodity futures. A maintenance margin is the minimum amount of equity that must be maintained in a margin account. The call for additional funds is known as the margin call.

Using a margin loan. Unlike the call buying strategy which have unlimited profit potential the maximum profit generated by call spreads are limited but they are also however comparatively cheaper to implement. The premium received is Rs 10 for the strike price of 970 and we assume a margin of 20.

Investors may please refer to the Exchanges Frequently Asked Questions FAQs issued vide. Variation margin is dependent on multiple factors such as the type of asset prevailing market conditions and expected price movements. A margin call is a broker s demand on an investor using margin to deposit additional money or securities so that the margin account is brought up to the minimum maintenance margin.

If your debt is lower you also decrease your risk of receiving a margin call. In early 21st century Margin Call America a man like Eric Dale could have been building bridges but instead hes devoted his skill to finance and indeed just before this story takes a bridge collapsed in Minneapolis. Value stock price - strike.

Before you can begin trading FO you must deposit an initial margin with your broker to protect it in the event that the buyer or seller suffers losses due to price volatility when trading futures and options. Is an SEC-licensed broker dealer and a CFTC-licensed futures commission merchant FCM and a member of FINRA SIPC CME NFA and several equities and futures exchanges which offers to self-directed investors and traders Equities accounts for stocks exchange-traded products such as ETFs and equity and index options and Futures. A leverageable account in which stocks can be purchased for a combination of cash and a loan.

A call spread is an option spread strategy that is created when equal number of call options are bought and sold simultaneously. Call options give the taker the right but not the obligation to buy the underlying shares at a predetermined price on or before a predetermined date. Margin interest rates are usually based on the brokers call rate.

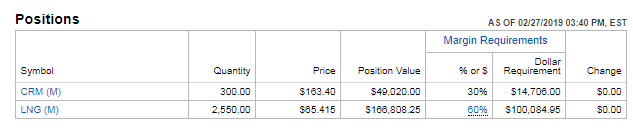

Stock Options 1 Call Price Maximum 20 2 Underlying Price - Out of the Money. An investor will need to sell positions or deposit funds or securities to meet the margin call. The loan in the margin account is collateralized by the stock and if the value of the.

Get the margin requirements for trading options as a resident of the US trading in US exchanges. Call Options capitalizing on investment knowledge. If you are an institution click below to learn more about our offerings for RIAs Hedge Funds Compliance Officers and more.

If funds are not. Thus the margin amount is Rs 116400 582000 x 20. Additionally unlike the outright purchase of call options.

An call options Value at expiry is the amount the underlying stock price exceeds the strike price. A sells 1 lot lot size is 600 shares of call option of Infosys. Options trading privileges are subject to Firstrade review and approval.

Calculate Fair Values of Call options and Put options for Nifty Options and a wide range of other Index and Stock options listed on the National Stock Exchange in India. Gain Futures Division risk department. Many margin investors are familiar with the routine margin call where the broker asks for additional funds when the equity in the customers account declines below certain required levels.

We survey more than 200 private equity PE managers from firms with 19 trillion of assets under management AUM about their portfolio performance decision-making and activities during the Covid-19 pandemic. Additional margin calls 28 Liquidity risk 28 Liquidity and pricing relationships 28 Orderly market powers 28 Trading disputes 28 Trading facilities 28. Margin for options example.

The Profit at expiry is the value less the premium initially paid for the option.

What Is A Margin Call Babypips Com

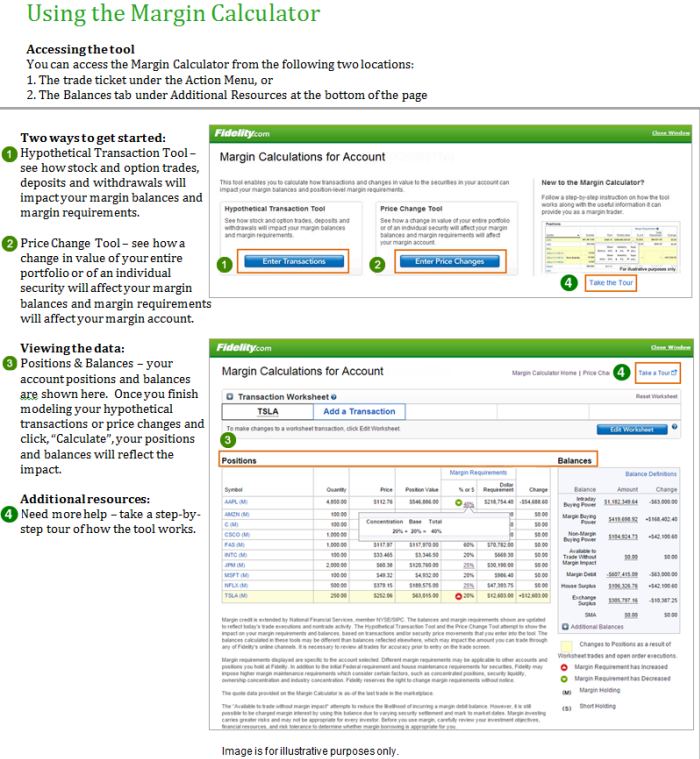

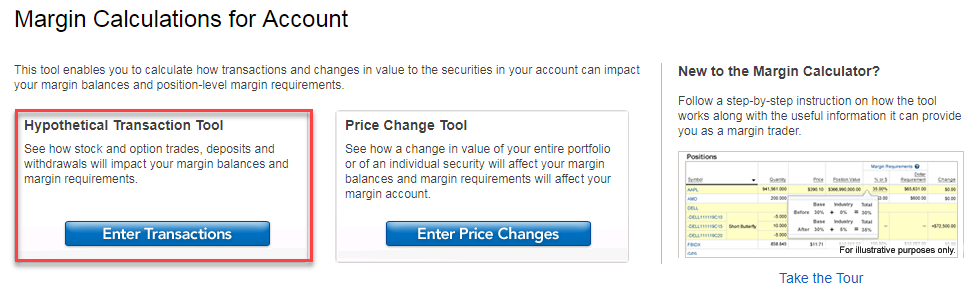

Trading Faqs Margin Fidelity

What Is Margin In Trading Meaning And Example

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

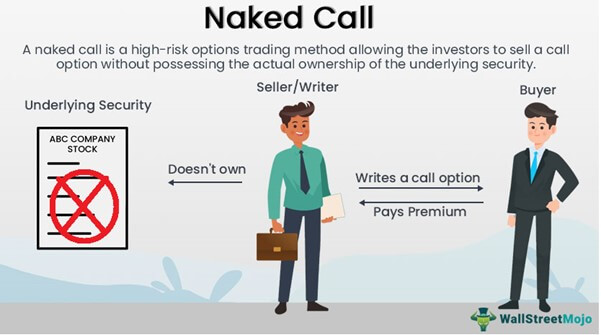

Naked Call Writing A High Risk Options Strategy

How To Handle Margin Calls Youtube

Avoiding And Managing Margin Calls Fidelity

Trading Faqs Margin Fidelity

Trading Faqs Margin Fidelity

Margin Call Meaning Explanation Examples Calculation

What Is A Margin Call Babypips Com

Trading Faqs Margin Fidelity

What Is Margin Call In Forex And How To Avoid One

Margin Call Price Formula And Calculator Excel Template

What Is A Margin Call Babypips Com

Trading Faqs Margin Fidelity

Naked Call Option Definition Examples Calculations

Trading Faqs Margin Fidelity